Service Tax Arrears Recovery: FAQs and Procedures

How Does Service Tax Arrears Recovery Work?

Introduction: In this comprehensive guide, we'll delve into the intricacies of service tax arrears recovery, exploring the processes, statutory provisions, and key considerations involved.

From understanding the triggers for arrears creation to navigating the appeals process, we'll cover everything you need to know to ensure compliance and mitigate risks effectively.

Understanding Service Tax Arrears: Service tax arrears arise from various scenarios, including confirmed demands, rejected appeals, and orders in favor of the revenue department. These arrears necessitate a structured recovery process outlined in statutory provisions like Section 73 and Section 87 of the Finance Act 1994.

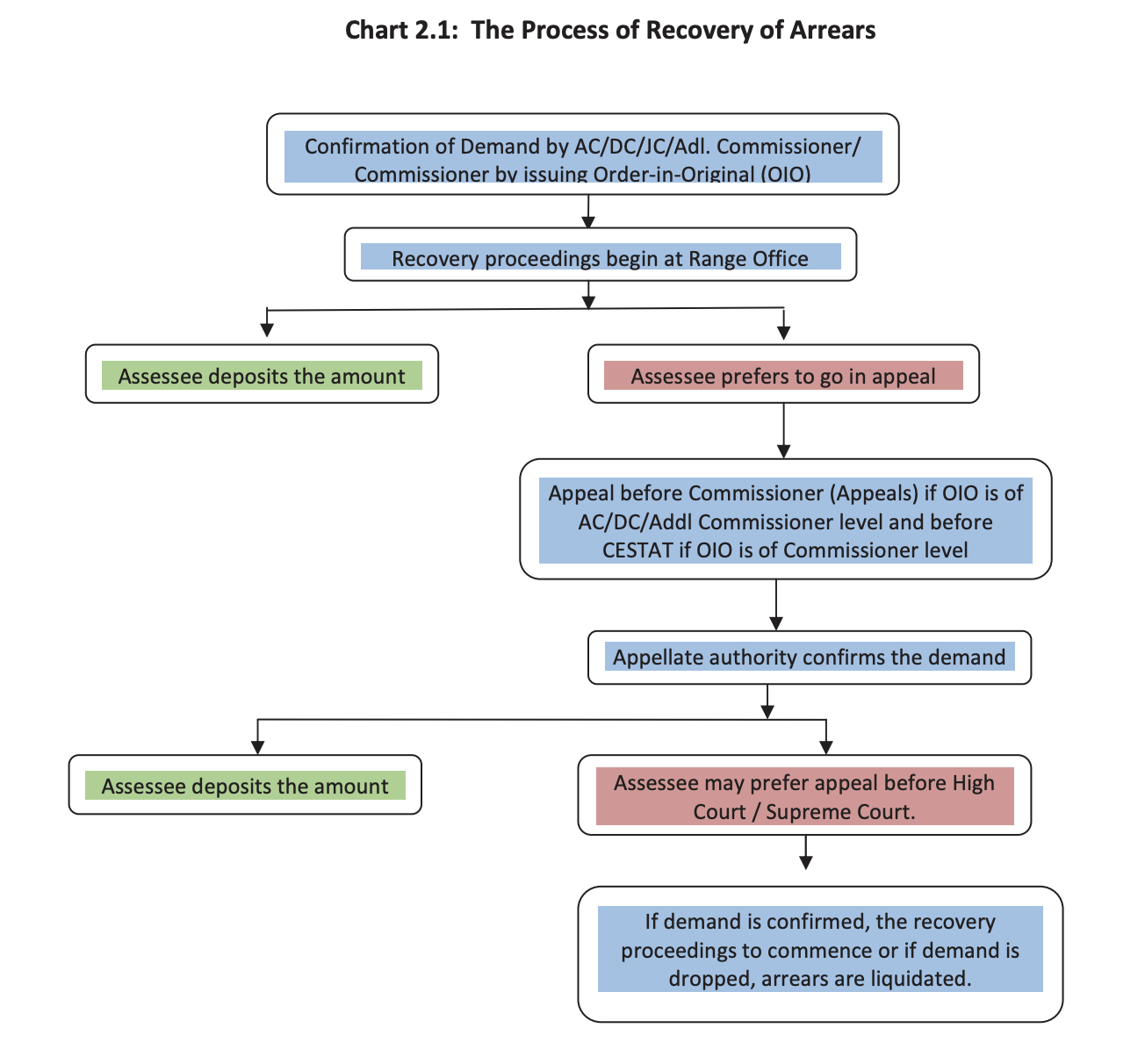

Key Steps in Arrears Recovery: The recovery process typically begins with the issuance of a demand notice, followed by appellate options for both the assessee and the department. Appellate authorities play a crucial role in confirming demands or dropping arrears, ultimately influencing the commencement or liquidation of recovery proceedings.

Navigating the Appeals Process: Assessees can choose to appeal before appellate authorities such as the Commissioner (Appeals) or the Customs, Excise and Service Tax Appellate Tribunal (CESTAT). Understanding the options available and the implications of each decision is vital for effective appeals management.

FAQs on Service Tax Arrears Recovery:

What Triggers the Creation of Service Tax Arrears? Service tax arrears are typically created when there is a confirmed demand for unpaid or underpaid service tax, either due to errors in self-assessment or non-compliance by the taxpayer.

What Statutory Provisions Govern Service Tax Arrears Recovery? Service tax arrears recovery is governed by statutory provisions outlined in Section 73 and Section 87 of the Finance Act 1994, empowering tax authorities to initiate recovery proceedings against defaulting taxpayers.

How Does the Recovery Process Unfold from Demand Notice Issuance to Final Settlement? The recovery process begins with the issuance of a demand notice by the tax authorities, followed by opportunities for the taxpayer to appeal against the demand. If the demand is confirmed, recovery proceedings commence, leading to the final settlement of arrears.

What Are the Options Available to Taxpayers and the Revenue Department During the Appeals Process? Taxpayers can appeal against the demand before appellate authorities such as the Commissioner (Appeals) or the CESTAT. Similarly, the revenue department can also challenge adverse decisions through the appellate process.

How Do Appellate Authorities Contribute to the Arrears Recovery Process? Appellate authorities play a crucial role in reviewing demand orders, considering evidence presented by both parties, and making decisions on the validity of the demand. Their rulings can impact the outcome of arrears recovery proceedings.

Are There Any Circumstances Where Arrears Recovery May Be Waived or Modified? In exceptional cases, arrears recovery may be waived or modified by the tax authorities, particularly if there are valid grounds for leniency or if the taxpayer demonstrates genuine hardship.

What Measures Can Taxpayers Take to Mitigate the Risk of Arrears Accumulation? Taxpayers can mitigate the risk of arrears accumulation by maintaining accurate records, conducting regular compliance audits, seeking professional tax advice, and promptly addressing any issues identified by the tax authorities.

What Are the Implications of Non-compliance with Arrears Recovery Procedures? Non-compliance with arrears recovery procedures can lead to penalties, interest accrual, and legal action by the tax authorities, potentially resulting in financial losses and reputational damage for the taxpayer.

How Can Businesses Ensure Timely Compliance with Service Tax Obligations to Avoid Arrears? Businesses can ensure timely compliance with service tax obligations by staying updated on relevant tax laws and regulations, implementing robust internal controls, and investing in ongoing staff training and development.

Leave a comment