Service Tax Arrears: Classification and Recovery FAQs

Understanding the Classification of Service Tax Arrears

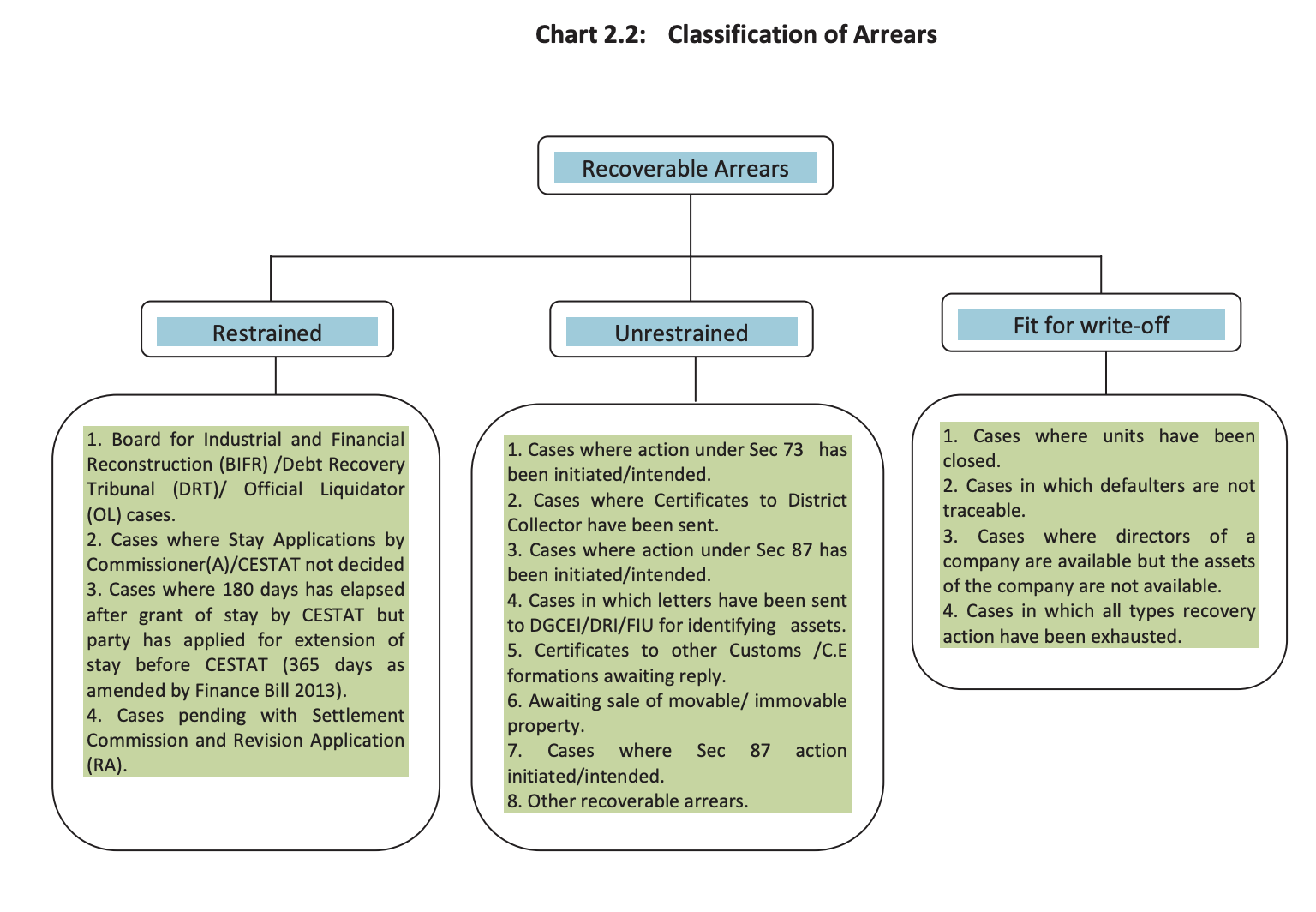

Arrears in service tax represent amounts owed to the government by taxpayers due to unpaid or underpaid taxes. These arrears are crucial for revenue collection and are classified into two main categories: recoverable and irrecoverable arrears.

Within the category of recoverable arrears, there are further distinctions based on the status of the arrears and their potential for recovery.

Classification of Arrears:

Recoverable Arrears: Recoverable arrears are those that can potentially be recovered by the government. They are further categorized into three subtypes:

Restrained Arrears: This category includes arrears that are currently restrained due to legal proceedings or other factors. Examples of cases falling under this category include those being considered by the Board for Industrial and Financial Reconstruction (BIFR), cases pending with the Debt Recovery Tribunal (DRT), or cases under the purview of the Official Liquidator (OL). Additionally, arrears for which stay applications are pending or stay extensions are being sought are also classified as restrained arrears.

Unrestrained Arrears: These are arrears where recovery action has been initiated or is intended to be initiated by the authorities. This category encompasses cases where action under Section 73 or Section 87 of the Finance Act, 1994, has been initiated or is planned. It also includes cases where certificates have been sent to the District Collector for recovery, letters have been issued to identify assets, or other recovery actions are underway.

Fit for Write-off: Arrears falling under this category are deemed unlikely to be recovered. This may include cases where units have closed down, defaulters are untraceable, or company assets are unavailable for recovery. Essentially, these are arrears where all possible recovery actions have been exhausted, and the likelihood of recovery is minimal.

Recovery Process Overview:

The process of recovering arrears typically involves several stages:

Demand Confirmation by Authorities: Arrears are confirmed by the appropriate authorities through orders-in-original (OIOs) or other adjudicatory processes.

Assessee Appeals Process: The assessees have the option to appeal against the demand confirmation through various appellate forums such as the Commissioner (Appeals), the Customs, Excise, and Service Tax Appellate Tribunal (CESTAT), or higher courts.

Recovery Proceedings Initiation: Once a demand is confirmed and appeals are exhausted, the revenue department initiates recovery proceedings against the defaulter. This may include actions such as issuing recovery notices, attaching movable or immovable properties, or referring the case to the District Collector for recovery.

Appellate Authority Decisions: The decisions of appellate authorities, such as the Commissioner (Appeals) or CESTAT, play a crucial role in determining the outcome of the recovery process. If the appellate authority confirms the demand, recovery proceedings continue; otherwise, the arrears may be liquidated.

FAQs on Arrears Classification:

What are the main categories of service tax arrears? Ans: Service tax arrears are classified as recoverable and irrecoverable arrears.

How are recoverable arrears further classified? Ans: Recoverable arrears are categorized as restrained, unrestrained, and fit for write-off based on their recovery status.

What distinguishes restrained arrears from unrestrained ones? Ans: Restrained arrears are currently under legal restraint, while unrestrained arrears are subject to recovery action or intended recovery action by the authorities.

When are arrears considered fit for write-off? Ans: Arrears are considered fit for write-off when all possible recovery actions have been exhausted, and the likelihood of recovery is minimal.

What steps are involved in the recovery process post-demand confirmation? Ans: The recovery process involves initiating recovery proceedings, appealing against demand confirmation, and obtaining decisions from appellate authorities.

What options do assesses have during the appeals process? Ans: Assesses can appeal against demand confirmation to appellate forums such as the Commissioner (Appeals) or CESTAT.

How do appellate authorities contribute to arrears resolution? Ans: Appellate authorities review the demands and appeals, and their decisions determine the outcome of the recovery process.

Are there circumstances where arrears may be waived or modified? Ans: Yes, arrears may be waived or modified under certain circumstances, such as settlements or compromise agreements.

What measures can be taken to prevent arrears accumulation? Ans: Timely compliance with tax obligations, regular monitoring of tax liabilities, and proactive communication with tax authorities can help prevent arrears accumulation.

What are the implications of non-compliance with recovery procedures? Ans: Non-compliance with recovery procedures may result in legal action, penalties, and adverse financial consequences for the defaulter.

Leave a comment