Optimizing Revenue Recovery: CBEC's Bunching of Cases Directive

Key Finding: Lack of Bunching of Cases

The Central Board of Indirect Taxes and Customs (CBEC) issued a circular directing Jurisdictional Commissioners to group together cases dealing with similar issues and significant revenue implications, requesting the Tribunal for expedited resolution. However, during audits, it was found that this directive was not followed in any of the 13 Commissionerates under examination.

Audit Observations:

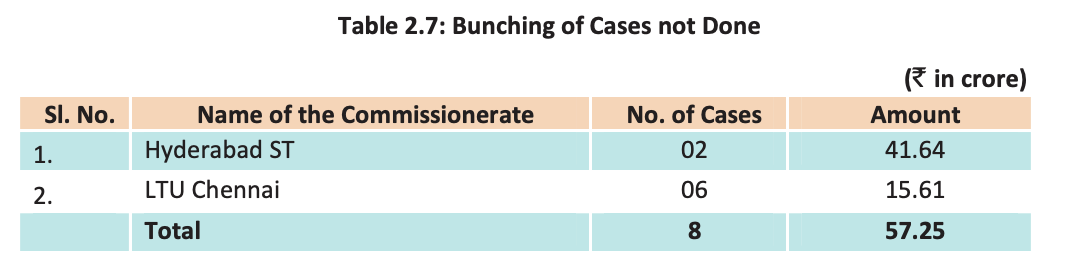

Despite clear instructions, none of the Commissionerates examined had bunched cases, resulting in delays in resolving cases and a backlog of arrears totaling ₹57.25 crore. Further scrutiny in two Commissionerates identified eight cases that could have been bunched together, indicating missed opportunities for efficient resolution.

Illustrative Cases:

For instance, in the Hyderabad ST Commissionerate, demands amounting to ₹9.63 crore against M/s PLR Projects Ltd. and ₹32.01 crore against M/s BGR Mining & Infra Pvt. Ltd. were confirmed, but no efforts were made to group these cases together, leading to prolonged resolution timelines.

Ministry's Response:

The Ministry acknowledged the oversight and mentioned that steps were being taken to request the Tribunal for linking relevant appeals and prioritizing their hearings. However, the progress on filing appeals and applications for bunching awaited further updates.

FAQs on Bunching of Cases:

What is the significance of bunching cases in CBEC's revenue resolution process? Bunching cases involves grouping together similar cases with substantial revenue implications, enabling streamlined resolution processes. It allows for more efficient utilization of resources, reduces duplication of efforts, and expedites the resolution of cases.

How does the lack of bunching impact the efficiency of case resolution and revenue recovery? The absence of bunching leads to inefficiencies in the resolution process, resulting in delays and backlog of cases. It hampers revenue recovery efforts as cases linger unresolved, prolonging the period before arrears are recovered and impacting the overall revenue collection targets.

What measures can CBEC implement to ensure effective bunching of cases and expedite their resolution? CBEC can implement proactive measures such as regular monitoring of cases, clear guidelines for identifying cases suitable for bunching, and enhancing coordination between Jurisdictional Commissioners and appellate authorities. Additionally, leveraging technology for case tracking and prioritization can streamline the bunching process.

What role does coordination between Jurisdictional Commissioners and appellate authorities play in facilitating the bunching of cases? Effective coordination between Jurisdictional Commissioners and appellate authorities is essential for identifying cases with similar issues and revenue implications. It ensures that relevant cases are grouped together and prioritized for resolution, enhancing the efficiency of the bunching process.

Leave a comment