CBEC's Service Tax Arrears Recovery: Trends & Solutions

Assessing CBEC's Arrears Recovery Performance

In this analysis, we delve into the performance of the Central Board of Indirect Taxes and Customs (CBEC) concerning the recovery of Service Tax arrears from 2012-13 to 2014-15, highlighting trends and challenges.

Performance Overview:

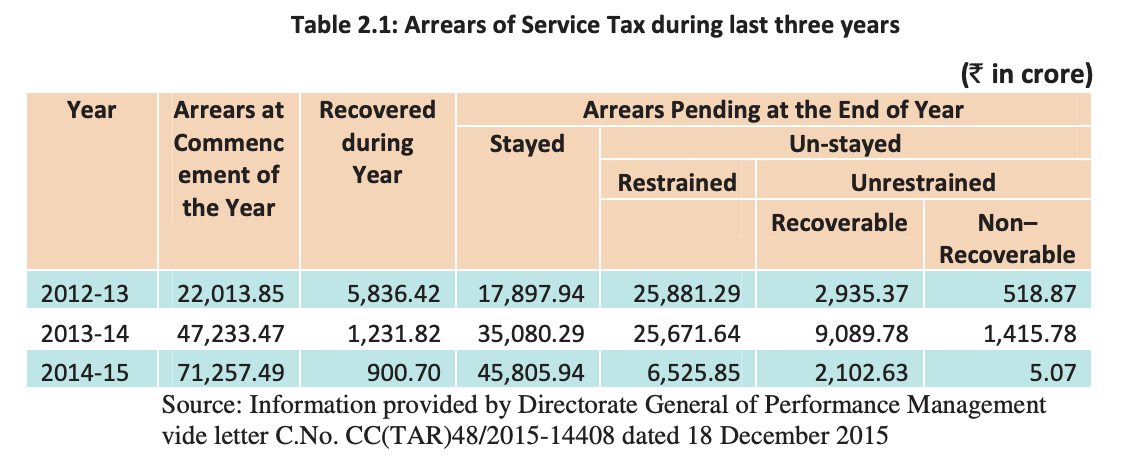

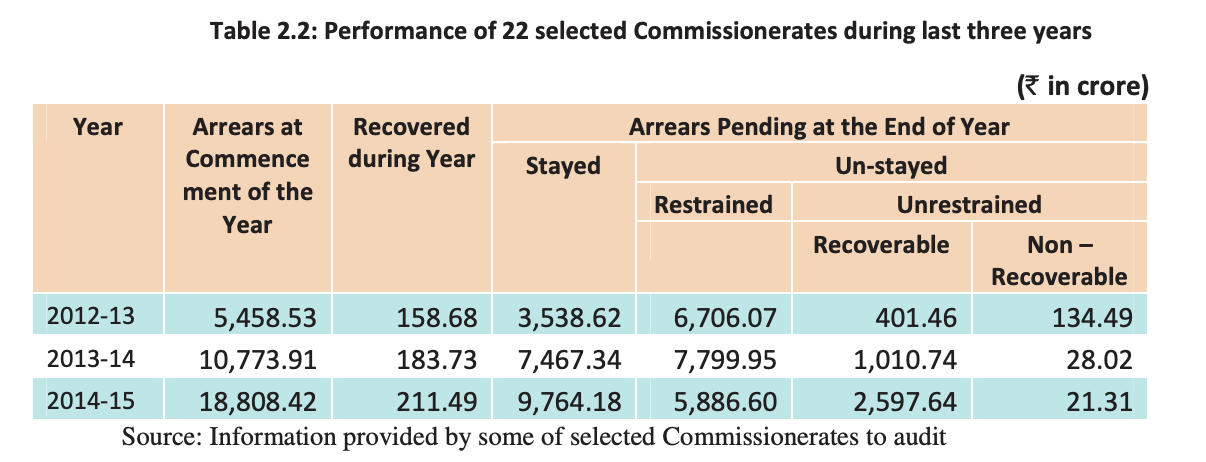

Arrears Escalation: Arrears of Service Tax at the year's commencement tripled in 2014-15 compared to 2012-13, indicating a significant increase in outstanding dues.

Recovery Decline: Despite the surge in arrears, the recovery of outstanding dues showed a declining trend over the three years. The percentage of recovery relative to unrestrained recoverable arrears notably decreased, posing challenges to the overall recovery process.

Commissionerate Analysis: Across the 22 selected Commissionerates, a consistent pattern emerged, with most experiencing a rise in arrears and a simultaneous decline in recovery. This trend suggests systemic challenges impacting arrears management and recovery efforts.

Key Observations:

Recovery Process Delays: Various steps in the arrears recovery process, such as the communication of Orders-in-Original (OIOs) and initiation of recovery proceedings, faced inordinate delays. These delays hindered the efficiency of the recovery process and prolonged the resolution of outstanding dues.

Monitoring Mechanism Absence: The absence of a systematic mechanism to monitor the status of arrear cases contributed to inefficiencies and oversight challenges. Without proper monitoring, tracking, and follow-up mechanisms, the management of arrears became more challenging.

Record Maintenance Issues: Improper maintenance of Appeal Registers and relevant records/data further complicated effective arrears management. The lack of organized record-keeping hindered accurate tracking of cases and impeded decision-making processes.

Strategy Deficiency: Zonal Tax Arrears Recovery (TARs) lacked a structured strategy for arrears recovery, leading to inconsistencies in approach and outcomes. A clear and comprehensive strategy is essential to streamline recovery efforts and maximize efficiency.

These key observations highlight the critical areas where improvements are needed to enhance the effectiveness and efficiency of arrears management and recovery within the Central Board of Indirect Taxes and Customs (CBEC).

FAQs on CBEC Arrears Recovery Performance:

1. What factors contributed to the declining trend in arrears recovery over the three-year period?

The declining trend in arrears recovery can be attributed to various factors, including delays in the recovery process, inadequate monitoring mechanisms, and a lack of structured strategies for arrears recovery. Additionally, the surge in arrears coupled with limited resources and capacity constraints may have further contributed to the challenges faced by CBEC in recovering outstanding dues.

2. How can CBEC address challenges like delays and inadequate monitoring mechanisms in the arrears recovery process?

CBEC can address these challenges by implementing streamlined procedures, enhancing communication channels between field formations, and investing in technology-driven solutions for better monitoring and tracking of arrear cases. Moreover, conducting regular audits and performance reviews can help identify bottlenecks and areas for improvement in the recovery process.

3. What strategies can improve the performance of Commissionerates with significant arrears recovery challenges?

Commissionerates facing arrears recovery challenges can benefit from the implementation of targeted strategies tailored to their specific needs. This may include enhancing staff training and capacity building, strengthening coordination between different departments, and adopting best practices from high-performing Commissionerates. Additionally, leveraging data analytics and technology can aid in identifying priority cases and optimizing resource allocation for maximum impact.

4. How can technology enhance CBEC's arrears recovery efforts and improve efficiency?

Technology can play a crucial role in enhancing CBEC's arrears recovery efforts by automating manual processes, facilitating real-time tracking of arrear cases, and improving data accuracy and accessibility. Implementing digital platforms for case management and communication can streamline workflows, reduce administrative burden, and enable proactive intervention in priority cases, ultimately leading to improved efficiency and effectiveness in arrears recovery.

5. What measures will CBEC take to ensure uniformity in arrears recovery outcomes across different Commissionerates?

Leave a comment