CBEC Recovery Delays: Analysis & Solutions

Key Finding:

Delayed or Non-initiation of Recovery Proceedings:

Despite legal empowerment under sections 73 and 87 of the Finance Act 1994, officers in multiple Commissionerates failed to initiate or delayed recovery proceedings, resulting in significant arrears remaining unrecovered.

Legal Provisions:

Section 73 grants Central Excise Officers the authority to serve notices for service tax arrears recovery, with a one-year time limit for normal cases and up to five years for cases involving fraud or willful misstatement. Section 87 allows officers to recover amounts from third parties holding funds for the assessee.

Audit Findings:

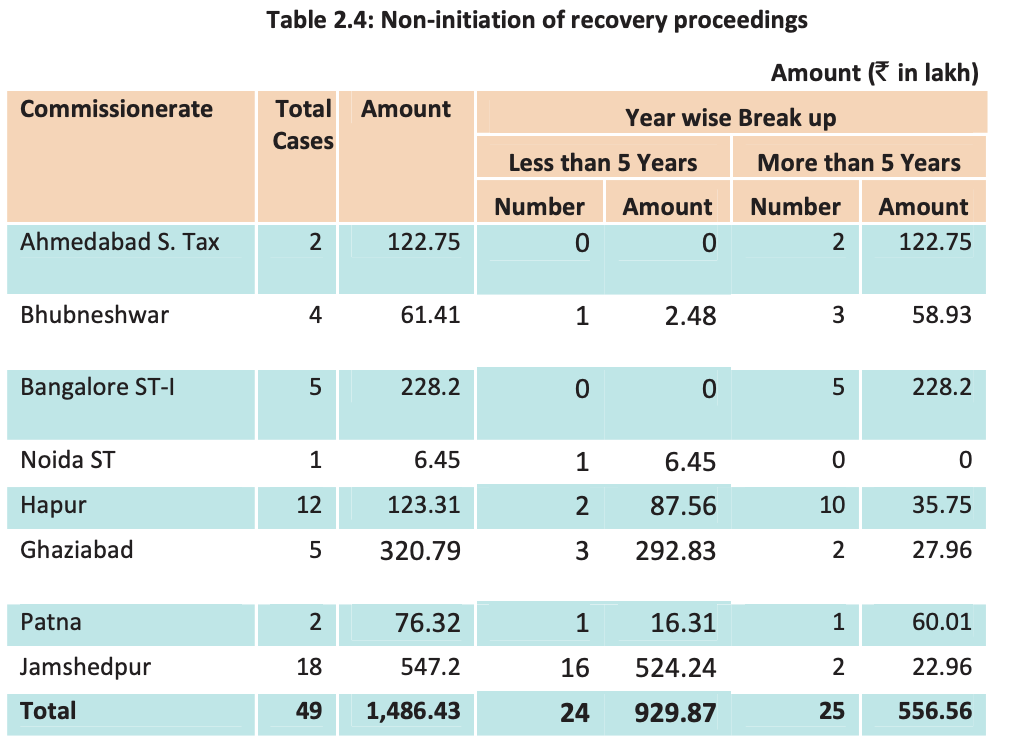

Audit identified 49 cases across eight Commissionerates where recovery proceedings were not initiated, leading to non-recovery of ₹14.86 crore. Illustrative cases demonstrate instances of delayed or non-initiated recovery actions despite confirmed demands.

Ministry's Response:

The Ministry provided varied explanations for delays, citing practical issues, procedural delays, and restructuring, without presenting a consistent approach to address the issue.

Additional Cases:

In eight cases spanning three Commissionerates, recovery actions were delayed by 19 to 80 months, further underscoring inefficiencies in the recovery process.

FAQs on Recovery Proceedings:

Legal Empowerment: CBEC officers are empowered by sections 73 and 87 of the Finance Act 1994 to initiate recovery proceedings for service tax arrears. Section 73 allows for the service of notices to recover unpaid or short-paid service tax, with time limits prescribed based on the nature of the case. Section 87 enables officers to recover amounts from third parties holding money on behalf of the assessee.

Consequences of Delay: Delayed or non-initiation of recovery proceedings can have significant consequences on CBEC's revenue collection efforts. It results in the accumulation of outstanding dues, leading to financial losses for the government. Moreover, prolonged delays weaken the effectiveness of the recovery process and erode taxpayer compliance.

Streamlining Process: CBEC can streamline the recovery process by implementing efficient procedures and timelines for initiating recovery proceedings. This includes establishing clear guidelines for officers, leveraging technology for tracking and monitoring cases, and conducting regular reviews to identify bottlenecks and areas for improvement.

Addressing Procedural Delays: To address procedural delays, CBEC should focus on improving coordination between different departments and stakeholders involved in the recovery process. Simplifying documentation requirements, enhancing training for officers, and adopting best practices from high-performing Commissionerates can help expedite recovery proceedings.

Leave a comment