Banking Ethics: Uncovering Unauthorised Deductions by SBI

Unauthorised Deductions Spark Customer Outrage: SBI Under Fire

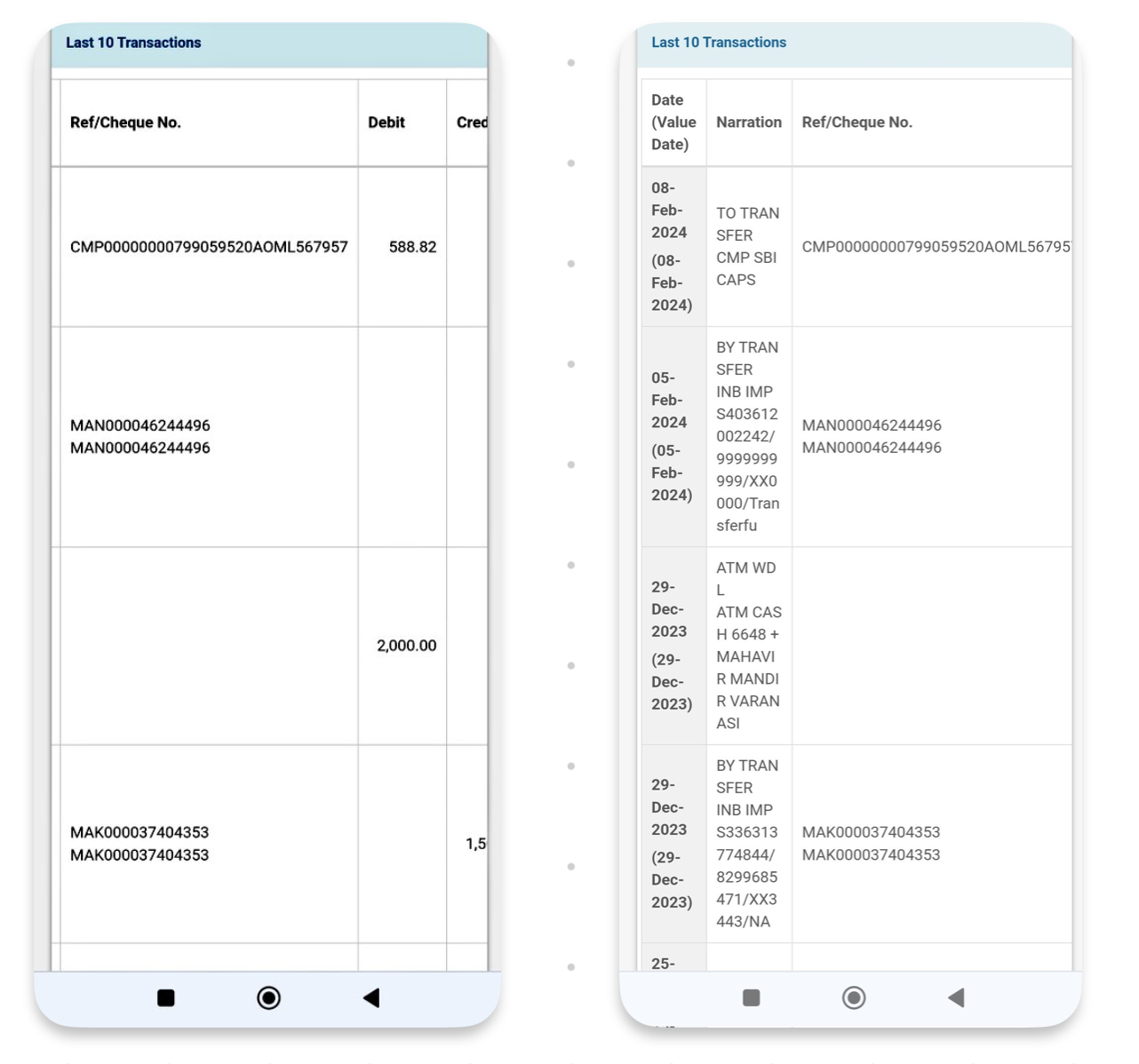

A recent social media outcry by Rajneesh Singh sheds light on alleged unauthorised deductions from his wife's State Bank of India (SBI) account, amounting to ₹588.82. This incident has ignited a debate on banking ethics and customer rights.

The Complaint: Rajneesh Singh took to Twitter to express his frustration, stating that the deduction was made in the name of a Demat account without his wife's consent. He further threatened to file an RTI to uncover the scale of such fraudulent activities.

Customer Frustration: In a series of tweets, Singh accused SBI of "hooliganism" and demanded transparency regarding the authority behind such deductions. He highlighted the inconvenience caused and questioned SBI's adherence to RBI guidelines.

SBI's Response: State Bank of India responded to Singh's tweets, expressing regret for the inconvenience caused and providing instructions to register a complaint through their official portal. However, Singh's attempts to lodge a complaint were reportedly unsuccessful, leading him to believe that it was a deliberate tactic to deter customers from complaining.

Email Correspondence: An email from SBI's CRM (Customer Relationship Management) team, shared by Singh, indicated that his feedback/complaint could not be registered. The email provided alternative avenues for lodging complaints but offered no explanation for the registration failure.

Implications and Call to Action: This incident raises concerns about the security of customer funds and the accountability of financial institutions. It underscores the need for robust mechanisms to address customer grievances promptly and transparently. Furthermore, it emphasizes the importance of awareness among banking consumers regarding their rights and avenues for redressal.

Conclusion: The saga of unauthorised deductions from Rajneesh Singh's wife's SBI account highlights broader issues of accountability and transparency within the banking sector. It serves as a reminder for both financial institutions and customers to uphold ethical practices and advocate for their rights.

Leave a comment