Aligned Export-Import Documentation: How to Streamline Procedures with Commercial and Regulatory Documents

Export-Import Procedures & Documentation Framework: Creating an Aligned Documentation System

In today's globalized world, efficient export-import procedures and documentation are crucial for businesses to navigate international trade smoothly. A well-organized and aligned documentation system ensures compliance with regulations, facilitates transactions, and minimizes delays. This article provides a comprehensive guide to establishing an aligned documentation system, covering both commercial and regulatory documents.

Situation Today:

The late 20th century witnessed a revolution in international trade with the introduction of computerized export documentation systems. This, coupled with the growing awareness of its benefits, led to a significant rise in the use of "aligned documents". But what exactly are these aligned documents, and why are they becoming increasingly popular?

Imagine international trade like a complex orchestra, where every instrument (document) plays a crucial role in harmonizing the flow of goods. Aligned documents act as standardized sheet music, ensuring all players, from exporters and importers to banks and customs officials, are reading from the same page. This eliminates confusion, minimizes errors, and significantly streamlines the entire process.

The benefits of aligned documents are evident in various sectors:

- Banking: Faster processing of trade finance transactions due to standardized information formats.

- Transport: Efficient cargo handling and clearance with readily available and consistent data.

- Customs: Simplified checks and reduced delays for compliant paperwork.

The magic lies in the categorization of these documents into two distinct groups:

- Commercial Documents: Focus on the business transaction, like invoices, packing lists, and bills of lading.

- Regulatory Documents: Ensure compliance with government regulations, such as certificates of origin and export licenses.

By following standardized formats and data elements within each category, aligned documents create a transparent and efficient ecosystem for international trade. This not only saves time and money but also fosters trust and collaboration between all stakeholders involved.

The future of international trade hinges on streamlined processes and efficient communication. In this context, aligned documents play a crucial role, paving the way for a smoother, faster, and more reliable global exchange of goods.

1. Commercial Documents:

While aligned documents ensure consistent communication in international trade, commercial documents are the lifeblood, facilitating every transaction smoothly. These essential documents bridge the gap between buyer and seller, outlining specifics and safeguarding interests on both sides.

Essential Roles:

- Invoice: The official bill, detailing the goods, their quantity, price, and payment terms. It serves as a record of the financial aspect of the transaction.

- Packing List: A detailed breakdown of the contents within each package, ensuring accurate identification and handling during shipment.

- Bill of Lading: Issued by the carrier, acknowledging receipt of goods for transport and acting as a title document for ownership transfer upon delivery.

These examples highlight the crucial contribution of commercial documents in:

- Clarity: Providing clear and precise information about the goods being traded.

- Transparency: Ensuring both parties understand their obligations and rights clearly.

- Efficiency: Enabling smooth processing of transactions through standardized formats.

- Security: Acting as legal records and evidence in case of disputes or discrepancies.

In essence, commercial documents are the essential language of international trade, ensuring effective communication and collaboration between exporters and importers for successful transactions.

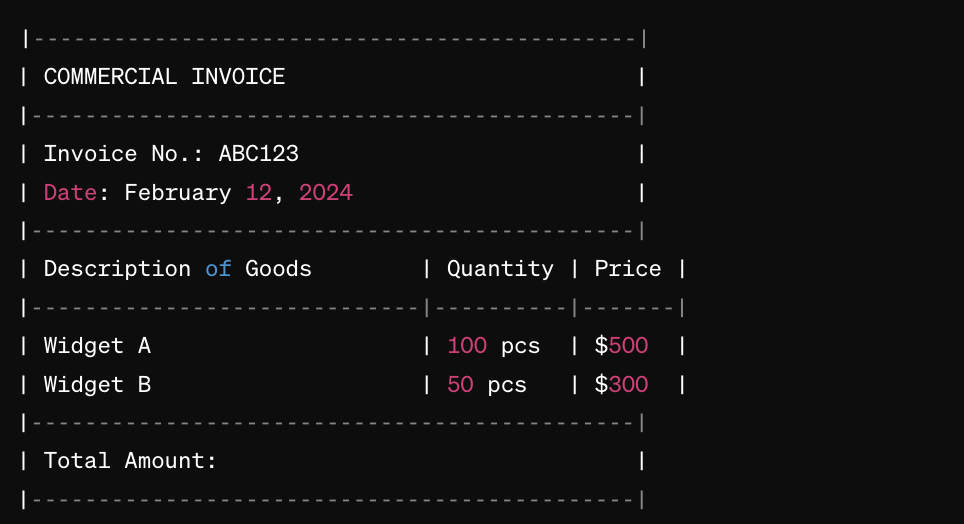

1.1 Commercial Invoice:

A detailed invoice issued by the exporter to the importer, containing information about the goods, prices, terms of sale, and payment instructions.

Example:

The commercial invoice plays a critical role in international trade, acting as the official bill and detailed record of the transaction between exporter and importer. It goes beyond a simple bill by providing numerous details vital for both parties and various stakeholders involved in the trade process. Let's dissect the example you provided:

Key components:

- Invoice No.: ABC123 - A unique identifier for this specific transaction.

- Date: February 12, 2024 - Documentation date for record-keeping and legal purposes.

- Description of Goods: Clear and concise description of each item being sold.

- Quantity: Exact number of units for each item.

- Price: Unit price of each item, clearly stating the currency used.

- Total Amount: The final sum payable by the importer for all goods listed.

Beyond the basics:

While these primary elements form the core of the invoice, it can often include additional information depending on the specific transaction and legal requirements:

- Terms of sale: Incoterms (International Commercial Terms) defining responsibilities and risk transfer points between exporter and importer.

- Payment instructions: Preferred method and timeframe for payment.

- Tax information: VAT, sales tax, or other applicable levies.

- Origin details: Country where the goods were produced or substantially transformed.

- Discounts or special arrangements: Any agreed-upon reductions or specific agreements.

Importance of the Commercial Invoice:

- Financial record: Serves as a legal document for both parties, recording the financial aspects of the sale.

- Customs clearance: Used by customs authorities to assess import duties and taxes based on the declared value and description of goods.

- Payment processing: Guides the importer on the correct payment amount and method as agreed upon.

- Dispute resolution: Provides evidence in case of disagreements regarding the transaction details.

Remember:

- Accuracy and completeness are crucial to avoid unnecessary delays, penalties, or disputes.

- Consult country-specific regulations and requirements for additional information that might be needed on the invoice.

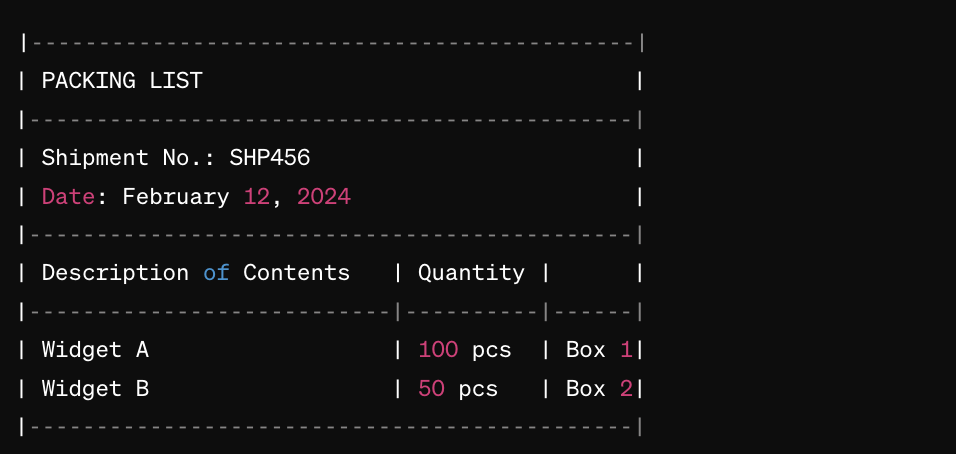

1.2 Packing List:

A detailed list provided by the exporter, specifying the contents of each package or container being shipped.

Example:

While the commercial invoice handles the financial side of things, the packing list serves as a detailed map of the physical shipment. It acts as a crucial communication tool for everyone involved, from the exporter packing the goods to the importer receiving them, and everyone in between. Let's dive into the example you provided:

Key components:

- Shipment No.: SHP456 - A unique identifier for this specific shipment, linking it to other related documents.

- Date: February 12, 2024 - Documentation date for record-keeping and ensuring clarity on shipment timing.

- Description of Contents: Clear and concise description of each item within each package.

- Quantity: Exact number of units for each item in each package.

- Package Identification: Reference to the specific container where each item is located (e.g., Box 1, Box 2).

Beyond the basics:

Depending on the complexity of the shipment and specific requirements, the packing list might include additional information:

- Weight and dimensions of each package

- Serial numbers or other identifying marks

- Special handling instructions (e.g., fragile, keep dry)

- Harmonized System (HS) codes for customs classifications

Importance of the Packing List:

- Efficient handling: Enables efficient loading, unloading, and identification of specific items within the shipment.

- Damage prevention: Clear labelling and instructions help prevent mishandling and potential damage.

- Inventory management: Facilitates accurate inventory checks and reconciliation upon arrival.

- Customs clearance: Customs authorities might use the packing list to verify declared goods and ensure accurate duty calculations.

Remember:

- Accuracy and completeness are crucial to avoid delays, damage, and potential customs discrepancies.

- Tailor the level of detail to the specific shipment and relevant regulations.

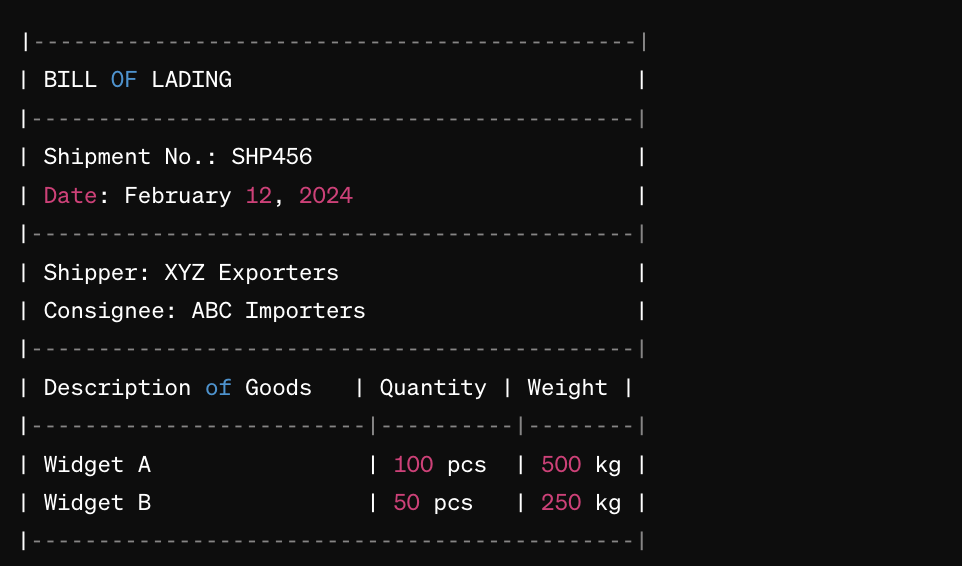

1.3 Bill of Lading:

A legal document issued by the carrier or its agent, acknowledging receipt of goods for shipment.

Example:

In the world of international trade, the bill of lading (BOL) plays a vital role as the official contract between the shipper and the carrier, acting as a receipt, a title document, and sometimes even a form of insurance. Let's unpack the example you provided to understand its key elements:

Key components:

- Shipment No.: SHP456 - Links the BOL to other related documents for smooth tracking.

- Date: February 12, 2024 - Records the date of shipment receipt by the carrier.

- Shipper: XYZ Exporters - Identifies the party sending the goods.

- Consignee: ABC Importers - Identifies the party receiving the goods.

- Description of Goods: Clear and concise description of each item being shipped.

- Quantity: Exact number of units for each item.

- Weight: Total weight of each item and the overall shipment.

Beyond the basics:

Depending on the specific shipment and incoterm used, the BOL might include additional information:

- Port of loading and discharge

- Freight charges and payment terms

- Special instructions or declarations (e.g., dangerous goods)

- Negotiability clause determining transfer of ownership

Importance of the Bill of Lading:

- Proof of shipment: Serves as legal proof that the goods were received by the carrier for transport.

- Title document: In certain circumstances, ownership of the goods transfers to the holder of the BOL.

- Contract of carriage: Outlines the agreed-upon terms and conditions of transport between shipper and carrier.

- Customs clearance: Used by customs authorities for verification and duty calculations.

- Dispute resolution: Provides evidence in case of disputes regarding damage, loss, or delivery issues.

Remember:

- Different types of BOLs exist (e.g., straight, negotiable) depending on the shipment and incoterm used.

- Carefully review and understand the terms and conditions before signing the BOL.

- Ensure its information aligns with other related documents (e.g., invoice, packing list).

2. Regulatory Documents:

Regulatory documents are essential for compliance with customs, export controls, and other government regulations. They include:

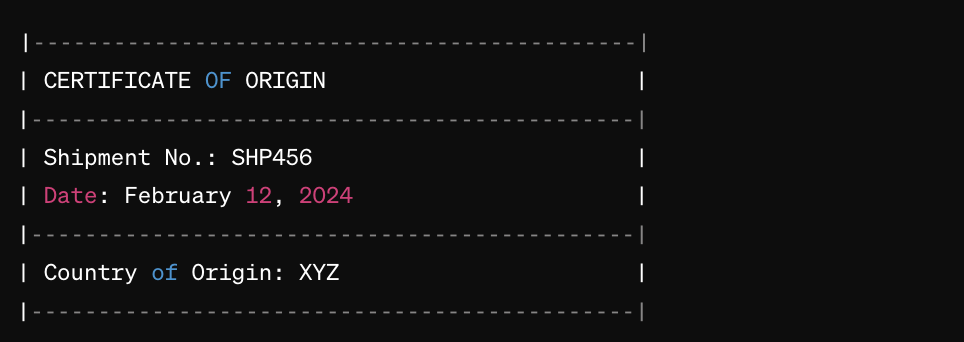

2.1 Certificate of Origin:

A document certifying the origin of goods, which may be required by customs authorities for tariff purposes.

Example:

In the complex world of international trade, certificates of origin (CO) play a critical role in determining where goods were produced. This information is crucial for various stakeholders, including:

- Customs authorities: They use the CO to assess import duties and taxes accurately, often based on trade agreements between countries.

- Importers: Knowing the origin can influence their purchasing decisions based on factors like quality, reputation, or ethical sourcing preferences.

- Exporters: A CO can help them claim preferential tariff rates under trade agreements, potentially reducing their costs and making their products more competitive.

Let's dissect the example you provided to understand the core elements:

Key components:

- Shipment No.: SHP456: Links the CO to the specific shipment for easy tracking and verification.

- Date: February 12, 2024: Records the date the CO was issued.

- Country of Origin: XYZ: Indicates the country where the goods were wholly obtained, produced, or substantially transformed.

Beyond the basics:

Depending on the specific requirements and trade agreements involved, the CO might include additional information:

- Detailed description of the goods

- Harmonized System (HS) code for customs classification

- Producer or manufacturer information

- Signature and stamp of the issuing authority

Importance of the Certificate of Origin:

- Accurate tariff calculation: Ensures fair and correct import duties are applied, avoiding potential disputes or penalties.

- Trade agreement benefits: Enables eligible exporters to claim preferential tariff rates, boosting their competitiveness.

- Market access: Certain markets might require a CO for specific goods to comply with regulations or qualify for certain benefits.

- Consumer confidence: Knowing the origin can influence purchasing decisions based on individual preferences or ethical considerations.

Remember:

- Different types of COs exist, and specific requirements vary depending on the countries involved and the value of the shipment.

- Consult relevant authorities and trade agreements to determine if a CO is required and what information needs to be included.

- Ensure accuracy and timely issuance of the CO to avoid delays or complications during customs clearance.

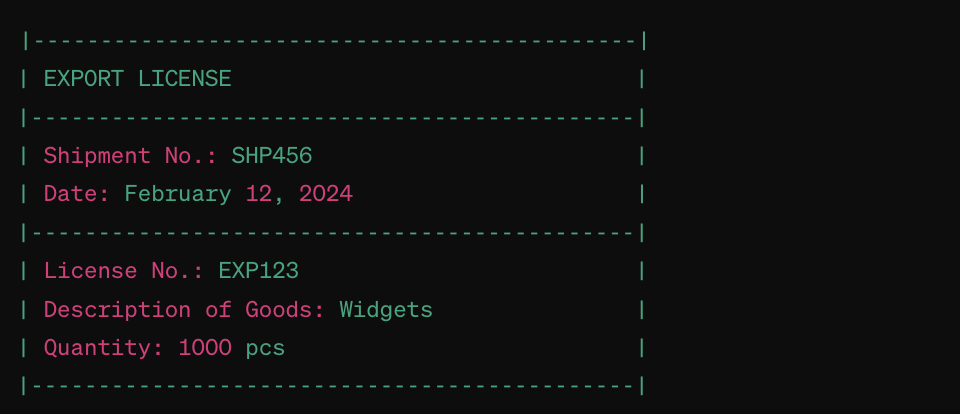

2.2 Export License:

A document issued by the relevant authority, permitting the export of certain goods subject to export controls.

Example:

In the realm of international trade, some goods require special permission to leave a country's borders. Here's where the export license steps in, acting as a vital gatekeeper to ensure responsible and controlled trade of specific items. Let's explore the example you provided to understand its key elements:

Key components:

- Shipment No.: SHP456: Connects the license to the specific shipment for proper tracking and verification.

- Date: February 12, 2024: Records the date the license was issued.

- License No.: EXP123: Unique identifier for this specific license, referenced in related documents.

- Description of Goods: Clear and concise description of the items authorized for export under this license (e.g., Widgets).

- Quantity: Exact number of units allowed for export under this license.

Beyond the basics:

Depending on the type of goods and regulations involved, the export license might contain additional information:

- End-user and end-use declaration: Specifying who will receive the goods and their intended purpose.

- Country of destination: Restricts export to specific countries based on international agreements or national security concerns.

- Special conditions or restrictions: Additional requirements or limitations attached to the export (e.g., dual-use items).

Importance of the Export License:

- Compliance with regulations: Ensures adherence to national and international export control laws, preventing the proliferation of sensitive goods.

- Protecting national security: Controls the export of items that could be used for military purposes or other sensitive applications.

- Promoting responsible trade: Helps prevent the export of goods that could harm human rights or the environment.

- Facilitating legitimate trade: Provides a framework for exporters to obtain approval for the legal export of controlled goods.

Remember:

Leave a comment